Jacksonville, FL — It’s a matter of paying $208 million toward pension obligations next year, or $349 million.

Not only do top officials in Jacksonville say their pension reform plan would mean big immediate savings, but they project a $1.4 billion impact over the next 14 years.

“They [reform plans] represent a historical change for our City, and they mark a new beginning for financial health of Jacksonville,” says Jacksonville Mayor Lenny Curry.

Curry and his senior staff started their big pension reform pitch to City Council Thursday with a nearly two hour presentation that- for the first time- included publicly releasing some of the financial details on anticipated costs and savings for their long fought reform plan. While the City Council signed on to the broad concept when they cleared a sales tax to be put up to a referendum, now is their first chance to dig in to details and approve collective bargaining agreements as well.

The history

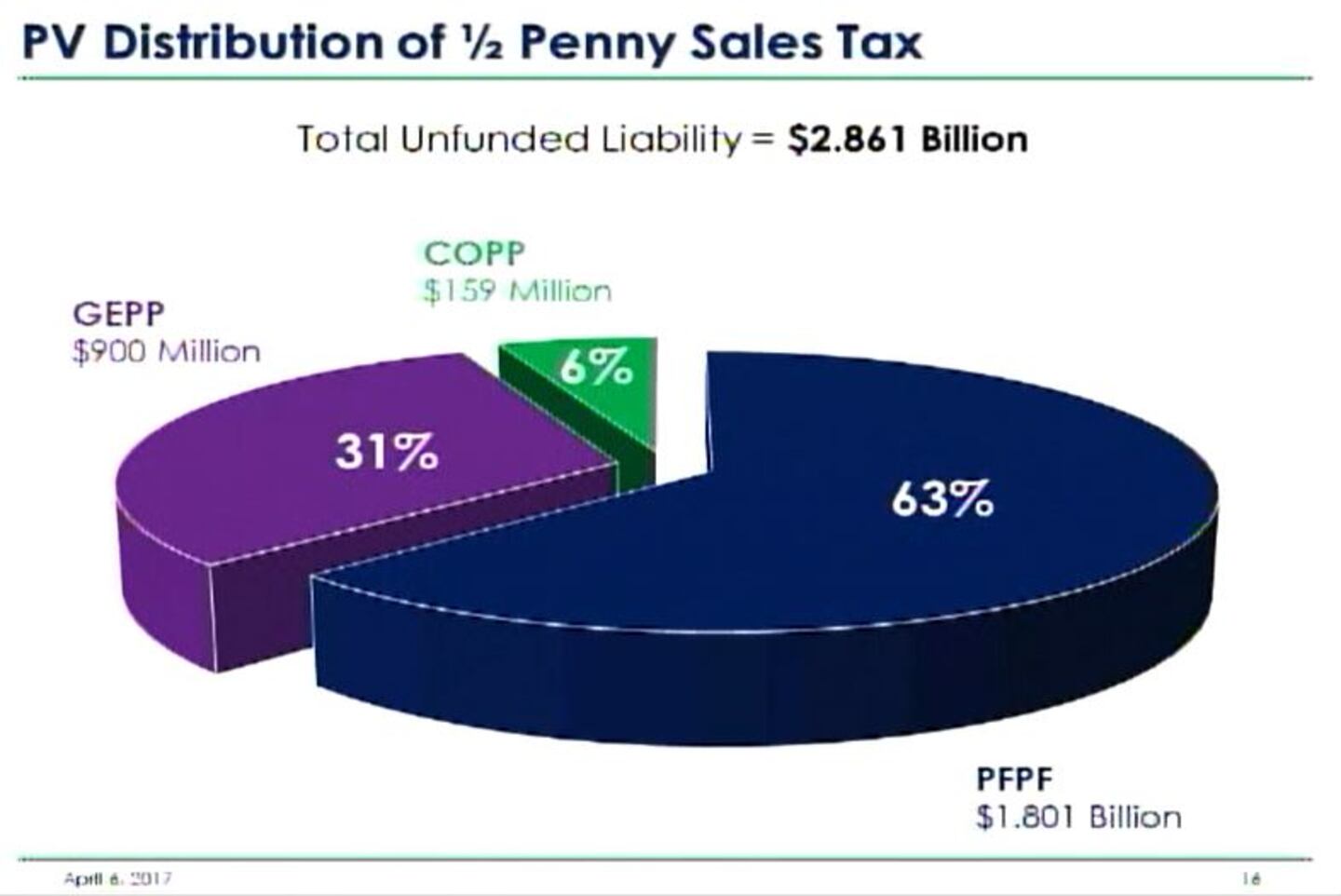

Curry vowed from the campaign trail to put forward a pension reform plan, and in January 2016 he introduced the concept of extending the half-cent Better Jacksonville Plan sales tax- which expires by 2030- through 2060, and using the proceeds to pay down the City's unfunded liability, or pension debt. That debt currently stands at around $2.86 billion, with all unions considered. The Police and Fire Pension Fund holds the main share, at $1.8 billion.

The State and City Council cleared the concept, and then Jacksonville voters approved the sales tax in August. Since then, the Administration has been working on collective bargaining, because they needed to close out traditional pensions in order to access the sales tax.

“The reform package you are reviewing ends those outdated, unsustainable, legacy pension systems that are bankrupting and crippling cities all over the United States,” Curry says.

That bargaining has resulted in new agreements, which are now in front of the Council, along with the mechanics of the sales tax.

The plan

While Mayor Curry gave an opening statement, most of the leg work today came from his Chief Administrative Officer Sam Mousa and Finance Director Mike Weinstein, who went page-by-page through a proposal detailing the goals, historical data, and current projections.

To put it simply, Mousa says it’s time to make expenses match with revenue, and enact comprehensive reform for the health of the City now and in the future. Their plan offers a dedicated revenue stream, in the form of the sales tax, while also including some safeguards to ensure the plans themselves are sustainable.

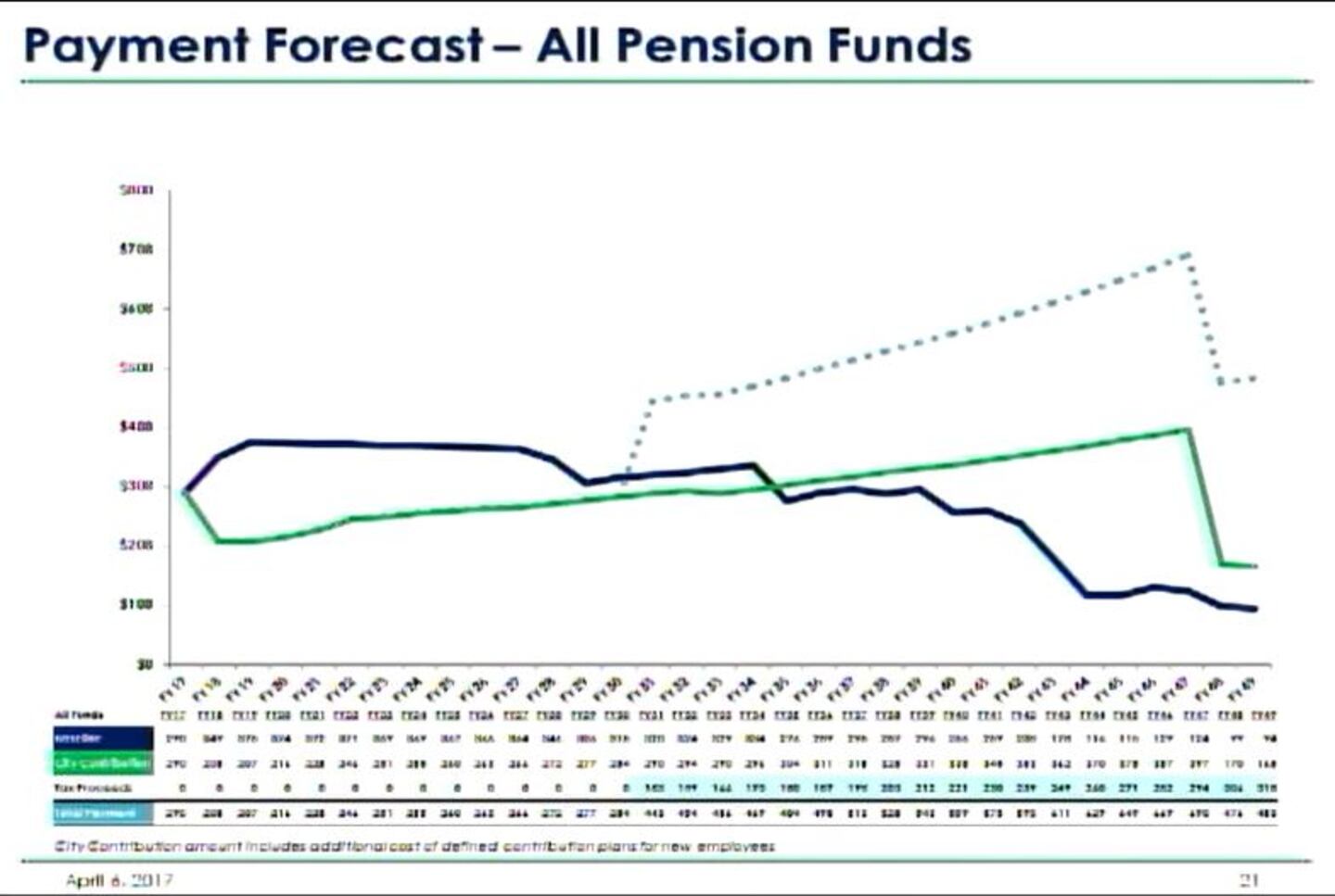

Over the next 14 years, the Administration says their reform plan will save $1.4 billion. Next year alone, the projected City contribution toward all pensions could fall from the $290 million paid this year to $208 million, or could increase to $349 million if nothing changes. This is done in large part through a 30 year re-amortization that reduces the annual required contribution in the near future, freeing up more money to be used for other City services.

Based on the slides presented to the City Council, through Fiscal Year 2050, the reform agreement actually costs about $256 million more, because much of the immediate burden is shifted to later years.

“You can’t pay off a $2.85 billion dollar invoice, without feeling it in some way,” Weinstein says.

A projection through the entire possible length of the sales tax, FY 2060, was not immediately provided.

While the plan appears to cost more with the bottom line over time, shifting the burden to later years is projected to mean the sum will actually have a smaller impact on the budget overall. In other words, paying the required amount now would be a large portion of the budget- eating up money otherwise used for things like public safety. Shifting that to future years, when the budget in itself is larger because of a projected increase in property tax revenue and other factors, makes the proportional burden less.

Sales tax revenue

The half-cent sales tax is currently projected to bring in about $9 billion, if used for its entire 30 year life, with an assumed growth rate of 4.25%. Mousa says they anticipate having all of the pensions fully funded by FY 2050 or 2051. If the final year the sales tax is collected is FY 2050, then the projected revenue from the tax is a little over $4.7 billion, according to the Administration’s figures. Mousa says the City Council will annually reassess the projection and is able to adjust the value as they see appropriate. Because the Administration expects to pay the debt down ahead of time, though, he believes lowering the value of the projected tax would lengthen the timeline to pay down, as opposed to putting the City in any financial trouble.

“We know this will cover it, we know we have a game plan here that’s going to fix it once and for all,” Mousa says.

The sales tax is allocated proportionally to the pension funds based on the size of the debt. So, for example, PFPF makes up $1.801 billion of the $2.861 overall pension debt, and therefore, gets 63% of the sales tax. If, at any time, one of the pension plans is fully funded, then the sales tax would be split proportionally between the remaining two.

The tax can only be used to pay down the pension debt, by law.

Collective bargaining

There are twenty-two collective bargaining units under three larger umbrellas- Police/Fire, Corrections, and General Employees- that had to agree to the new proposed benefits and pay. While those collective bargaining agreements are still pending a City Council vote, that is an up-or-down vote, not something that can be amended. The bargaining agreements include pay raises and a one-time bonus, as well as the restoration of some benefits cut under a 2015 reform plan specifically for Police and Fire. New hires will also be moved to a new 401(k)-style plan, rather than the current defined benefit model, and existing employees are increasing their contribution to their plans.

Collective bargaining is required every three years, but as Mousa explains it, there are “triggers” built in to facilitate that process. One trigger deals with the annual growth rate for property taxes and the other is about how the return on investment matches up to the actuarial assumed rate. When the collective bargaining happens after the first three years of this agreement, Mousa says if both of the triggers are “in the green”- or the conditions are met- then things will proceed as they are. If one of the triggers goes “in the red”, then that forces a new dialogue. The current agreement would have three three-year periods and a final single year, with a session at the bargaining table in between each.

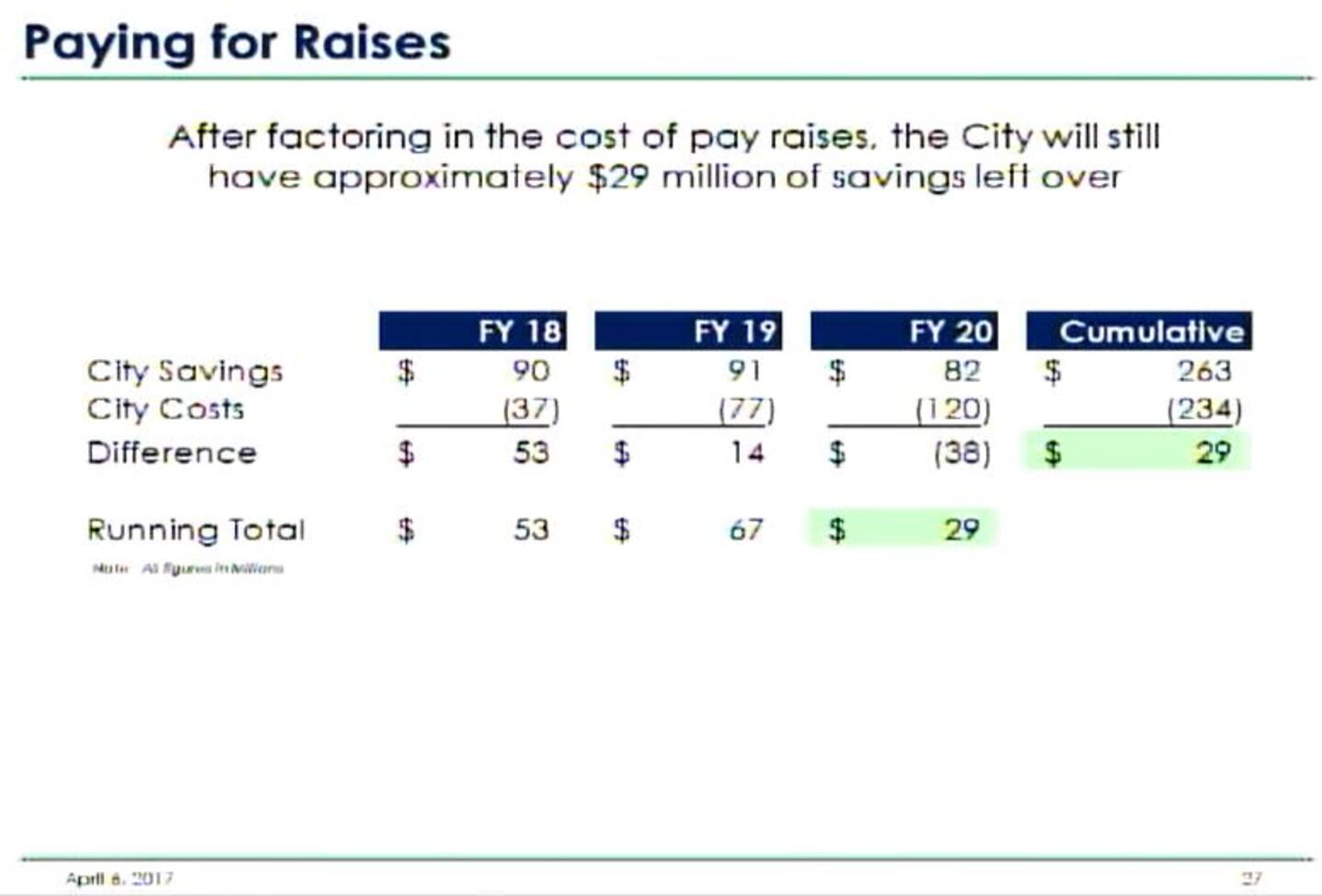

The pay raises were an area of focus in regard to their impact on the bottom line. Weinstein says the money is essentially already available to cover the one-time payments, which would total around $10.7 million. That funding would come largely from money previously set aside to help with collective bargaining. With the raises that take effect over the next three years, the total builds, but he says it can be covered.

The projected cost of the pay raises in FY 2018 is $37 million, but the City is expected to save $90 million through the reform plan. The following year’s cost is $77 million, with a $91 million savings. In all, that’s a net difference of $67 million. Weinstein says if the City is smart and saves that, it can be used toward FY 2020, when the cost of pay raises actually exceeds the savings, $120 million to $82 million respectively. If the prior savings are applied, the City is still ahead $29 million over the three years.

There are no figures on potential raises more than three years out, because that would be subject to collective bargaining.

Safety nets

In order to help ensure the fiscal stability of the funds, the Administration has built in three “safety nets”. The first is a liquidity floor of five years, which essentially means that the funds will always have enough cash to payout five years of benefits, even if no new money comes in. The Administration’s current projections have all of the funds above that floor, although the PFPF gets close after about FY 2031. If any fund falls below the floor, the City would be required to pay more in to it.

City contribution overall is the second safety net, with the deal requiring an annual minimum contribution of $110 million to PFPF, $60 million to General Employees, and $10 million to Corrections. Even if the required City contribution falls below that amount, the City will pay at least this sum annually in order to continue to work toward fully funding the plans.

The third safety net is the annual review by City Council of the sales tax growth assumption, as previously mentioned.

City Council

Approval by the Jacksonville City Council is the final hurdle to get this process in place.

Thursday’s workshop was the first of several specially designated gatherings, with another workshop planned for April 12th and a possible Council Committee of the Whole meeting slated for April 19th. The bills are up for a second reading April 11th, and will also be subject to public hearing at that time. Additionally, Mousa and Weinstein have meetings set with each Council member individually to work through their questions and concerns.

A few of those questions started to get aired out Thursday. Some wanted projections beyond FY 2050, which weren’t included in the slides, and the Administration said they would provide that. One questioned the potential impact of future negotiated pay increases for employees beyond this first three year stretch, and the answer was that it was difficult to say because of future collective bargaining. Related to that, a Councilwoman had concerns about the collective bargaining triggers being based on financial data from prior years, without consideration for future economic projections. Another asked whether the City’s ratings agencies had given any thought to the proposal, and, overall, it’s being viewed as positive to address the pension issue, although they don’t comment on specific proposals until they’re enacted.

Despite these questions, many spoke in praise of the Administration for crafting the proposal and laying it out as they did, calling the proposal a creative solution.